By: Todd Spangler

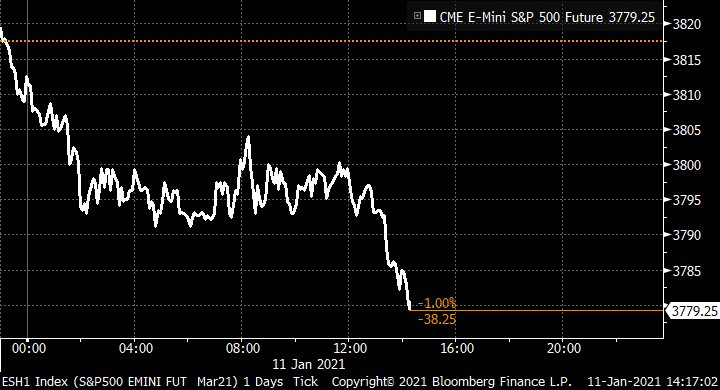

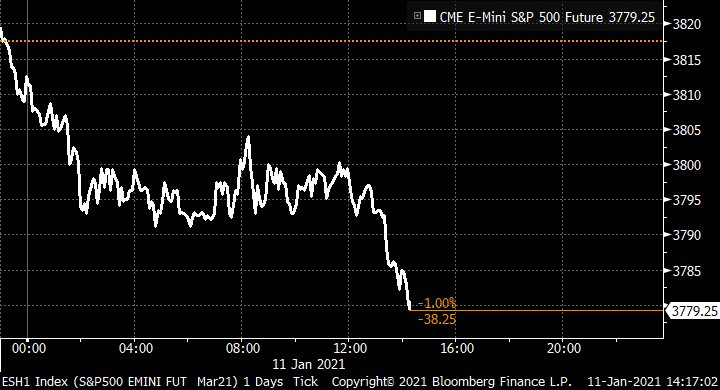

UPDATED: Shares of Twitter took a nosedive in early trading Monday, coming after the social network permanently banned Donald Trump — its highest-profile user — prompting worries that would hurt user and revenue growth.

Twitter’s stock dropped as much as 12% at the market open Jan. 11, before recovering some lost ground to around -8% by 10:30 a.m. ET.

The decline comes after Twitter shares had a 37% run-up in the last two months of 2020. The Dow was down 0.3% and the Nasdaq Composite was -0.6%. Shares of Facebook, which suspended Trump’s Facebook and Instagram accounts until at least his departure from the White House, were down 2.7%.

Investors view Twitter’s booting of Trump, along with the removal of other right-wing accounts, as a potential drag on user growth going into 2021. On Friday afternoon, Twitter issued a permanent ban on Trump, citing his repeated violation of the rules and risks that the outgoing president could incite further violence after the deadly riot at the U.S. Capitol on Jan. 6.

Just as media investors were quick to short Fox Corp.’s stock post-election over fears Fox News Channel will suffer lower viewership after Trump’s loss, Twitter is similarly at risk, MoffettNathanson senior analyst Michael Nathanson suggested in a research note Monday.

Twitter’s daily active users in the U.S. “are still very small and at risk of stalling” with Trump’s exile from the platform, Nathanson wrote. “We have always wondered how much of Twitter’s growth came from the ‘Trump Bump’… Now we will find out.”

Despite a risk of “churn from the conservative community” for Twitter, “strong political activists will stay on Twitter for other content,” Bank of America analyst Justin Post wrote in a research note Monday, retaining a “buy” rating on the stock.

In addition, “we think other Tweeters can replace Trump,” he opined, noting that president-elect Joe Biden’s Twitter account has added more than 4 million followers since he was confirmed as the winner of the 2020 election in mid-November.

In the fourth quarter, Twitter’s stock climbed over an expected bump in 2021 brand advertising, and the return of events like the Tokyo Summer Olympics and the NCAA men’s basketball championship, Nathanson noted.

But at the same time the company faces increased regulatory risks, and Twitter continues to trail competitors like Facebook in monetizing its user base, the analyst wrote.

Twitter is scheduled to report Q4 2020 results on Feb. 9 after the market closes. The company had issued an uncertain ad forecast for the last three months of the year, telling investors in late October, “As we approach the U.S. election… it is hard to predict how advertiser behavior could change,” noting that in the second quarter of 2020 many brands “slowed or paused” spending in reaction to protests and civil unrest in the U.S.

more recommended stories

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl Trafficking

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl TraffickingFentanyl Seizures at Border Continue to.

Utah Man Sentenced for Hate Crime Attack of Three Men

Utah Man Sentenced for Hate Crime Attack of Three MenTuesday, August 8, 2023 A.

Green Energy Company Biden Hosted At White House Files For Bankruptcy

Green Energy Company Biden Hosted At White House Files For BankruptcyAug 7 (Reuters) – Electric-vehicle parts.

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrn

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrnFriday, July 21, 2023 A former.

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human Remains

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human RemainsSCRANTON – The United States.

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide Demonstrations

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide DemonstrationsThe Department of Justice announced that.