Update: Ryan Todd Powers was sentenced to 20 years in state prison.

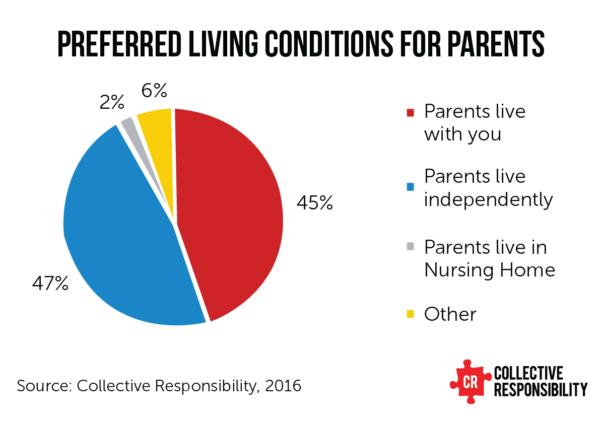

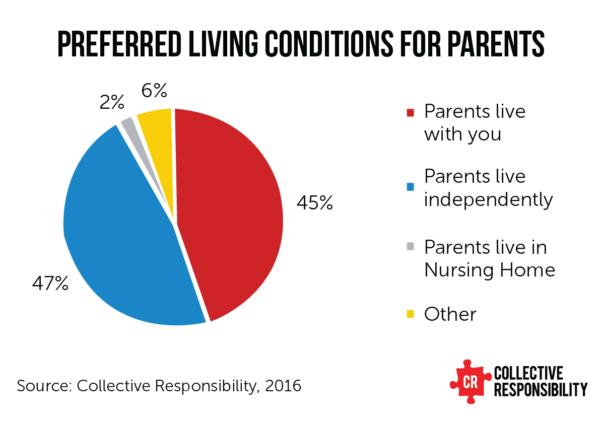

“I don’t want to die in a nursing home.”

That was why Janet Powers and her husband, William, bought a house in Lehigh Acres where their son, Ryan Todd Powers, was living.

The plan, when the couple could no longer live independently in their manufactured home in Alva, was to move into a mother-in-law suite at the North Avenue house. There, they could live out their final years – cared for and surrounded by family.

The couple signed a durable power of attorney giving their son access to their finances. When Ryan sold their home in Alva, the $72,000 was supposed to be used for remodeling the North Avenue home and for his parents’ income and care.

Documents filed with the Lee County Circuit Court tell a different story.

According to the records, the younger Powers spent the money and his mother’s Social Security to buy pizza, rent movies and pay for his cellphone.

He left his parents in nursing homes refusing to pay the bills. And when William Powers died, Ryan wouldn’t pay the funeral home.

William Powers’ body went unclaimed for 90 days. Finally, Lee County picked up the remains and Powers was cremated at taxpayer expense.

In September a Lee County jury found Ryan Powers, 41, guilty on four counts of first-degree exploitation involving an elderly person.

He faces up to 60 years in prison. His sentencing is Monday, two years to the day that he opened a fraudulent checking account in his mother’s name and began his scheme to defraud.

Power of attorney

Ryan was Janet and William’s only living child.

Janet thought William coddled him too much.

She questioned the wisdom of buying a home for Ryan, his wife, Brandy, and their children to live in, she told Earl Rutland, a law enforcement investigator in the Attorney General’s Medicaid Fraud Control Unit. But she went along with her husband’s plan.

The couple, both in their early 70s, paid an attorney to draft a Durable Power of Attorney giving Ryan control over their financial and legal affairs.

Two months later, Ryan redirected Janet Powers’ $808 monthly benefit checks from the couple’s joint checking account to the one in his and his mother’s names. Over the next 10 months, Ryan used a debit card 136 times to tap the account for cash and to pay for purchases at places such as convenience stores and a pawn shop.

In early 2016, William Powers told Ryan to sell the couple’s trailer in Alva and use the proceeds to remodel the Lehigh house, still in the elder Powers’ names, so they could move out of the nursing homes and live together.

William was in a nursing home in North Fort Myers, more than 100 miles away from Janet who had been moved to a nursing home in St. Petersburg. It was the nearest one that agreed to take a patient on Medicaid, the government program that pays for health care for people who have little or no money.

In order to qualify Janet for Medicaid, the nursing home needed financial information. Ryan wouldn’t supply it but did give the nursing home bank statements that appeared fraudulent, prompting a call to the Department of Children and Families Adult Protective Services.

To catch a thief

Janet Powers told the DCF investigator she believed her son was stealing her money.

Ryan told another DCF investigator he only used the bank account to pay his mother’s bills. He had sold the trailer, he said, for $60,000 and it had a mortgage of $50,000 and he had to pay taxes on the sale.

The investigation by Rutland, the agent with the Attorney General’s office, showed the home sold for $72,000. Most of the money, minus $6,000 in cash given to Ryan, was deposited into William and Janet’s bank account. The buyers paid the trailer park fees and taxes.

Wells Fargo’s anti-fraud program wouldn’t let Ryan access the money until the buyers’ check cleared. Four days later, he withdrew $50,000 from his parents’ joint account, putting the money on a cashiers check. He went back to the bank several times, cashing the check, getting cash, and then getting another cashier’s check for the difference.

William Powers told Rutland he didn’t know what happened to the money from the sale of the trailer. He wanted to be with his wife. He wanted to revoke his son’s power of attorney.

A week later, on July 5, 2016, William Powers died. The nursing home had been paid for July and because William had died on the 5th, Ryan was looking for the refund. He needed it to pay the funeral expenses, he told the business manager at the nursing home. The manager, “did not believe he would do so,” Rutland wrote in his affidavit. “She tried to persuade him to let her pay the funeral home, but he refused.”

Ryan picked up the $3,722.50 refund check from the nursing home and stopped at a nearby check cashing store. He left with $3,554.99 in cash. The funeral home was never paid and the county cremated William Powers.

After numerous failed attempts at an interview, Rutland was able to catch Ryan at home at 7 a.m on Nov. 1, 2016. In a recorded statement, Ryan told the investigator he had given his dad most of the money from the sale, in cash, and was using the rest to remodel the house for them, adding the suite Janet Powers had talked about.

When Rutland asked to see the remodel, he was shown the garage. There was a motorcycle, ATV and a personal watercraft, a partially tiled floor, but no rooms. There was “no evidence in any part of the house that shows recent repairs or improvements,” Rutland wrote.

Three weeks later Ryan filed a handwritten quit claim deed to take ownership of the Lehigh Acres house. Janet didn’t sign the deed and William was dead. Ryan signed for both as the power of attorney.

Ryan was arrested in December and charged with exploitation of the elderly. He was released the next day, but in January was arrested again for grand theft for continuing to use the power of attorney to sell his parents’ truck.

During the trial, Ryan testified he was acting at the behest of his father. His dad had told him not to pay his mother’s nursing home bills, to sell the Alva home and to transfer ownership of the Lehigh Acre house, he said.

The jury didn’t buy it. And on Sept. 1, following a four-day trial, Ryan Todd Powers was convicted of four counts of exploitation of the elderly.

Common crime

Financial exploitation of the elderly is not unusual. That the perpetrator of the crime was a relative isn’t either. What makes this case unusual is that the victim came forward and law enforcement pursued it.

“Those are the two highest hurdles to get over,” said David Kessler, a certified fraud investigator who trains law enforcement to investigate crimes against the elderly.

“Tracking the money and dealing with the perpetrator,” is the easy part, he said. The difficulty comes in getting victims to implicate their loved ones and getting law enforcement to recognize this as a crime and not a civil or “family matter.”

Kessler offered kudos to Assistant State Attorney Jennifer Royal, who took the lead on the Powers case. Even if law enforcement officers recognize the crime, often prosecutors are reluctant to take the case because the victims are thought to be unreliable witnesses, Kessler said.

“But they are the best witnesses in the world,” he said. “Jurors can relate” to a vulnerable elderly person and can see “how their loved ones can be taken advantage of.”

The crimes leave the victims not only destitute but traumatized. “It goes far deeper than monetary value, the (perpetrator) has raped those people emotionally. He’s stolen their dignity.”

“The only good thing about (the Powers) story,” Kessler said, “is the elderly gentleman wasn’t alive to realize his son didn’t care about him even in death.”

Poised for growth

Carolyn Rosenblatt is a registered nurse and elder law attorney. She and Dr. Mikol Davis are the authors of The family guide to aging parents and run the website agingparents.com.

Only 1 in 44 cases of elderly exploitation gets reported Rosenblatt said, because people are too embarrassed, don’t want to “rock the boat or don’t want their son or daughter to go to jail.”

The key is to prevent the abuse from occurring in the first place. Rosenblatt said part of the problem rests with family members who “don’t want to face the fact that elderly members are beginning to fail.”

They are also reluctant to confront a family member who is the thief.

Lawyers, too, can be a problem. “Estate planners are not doing enough to protect people from abuse,” Rosenblatt said. Often they draw up the papers and they are done. “We are attorneys and counselors. And the counselor part gets lost.”

Unless something is done to start protecting elderly people from financial exploitation the problem will only get worse, Rosenblatt said. “Some people call it the crime of the century,” and with a U.S. population of 50 million seniors by the year 2019, “you can see why.”

What is adult exploitation?

Adult exploitation means a person who stands in a position of trust and confidence with a vulnerable adult knowingly, by deception or intimidation, obtains or uses, or endeavors to obtain or use, a vulnerable adult’s funds, assets, or property with the intent to temporarily or permanently deprive a vulnerable adult of the use, benefit, or possession of the funds, assets, or property for the benefit of someone other than the vulnerable adult.

Or

That a person who knows or should know that the vulnerable adult lacks the capacity to consent, obtains or uses, or endeavors to obtain or use, the vulnerable adult’s funds, assets, or property with the intent to temporarily or permanently deprive the vulnerable adult of the use, benefit, or possession of the funds, assets, or property for the benefit of someone other than the vulnerable adult.

Florida law requires the reporting of known or suspected abuse, neglect, exploitation, or self-neglect of vulnerable adults (elderly or disabled). the Florida Abuse Hotline receives reports 24 hours a day. call 1-800-962-2873 or 1-800-96-ABUSE. report online at https://reportabuse.dcf.state.fl.us. If you suspect or know of a vulnerable adult in immediate danger, call 911.

Source: Florida Department of Children and Families

more recommended stories

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl Trafficking

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl TraffickingFentanyl Seizures at Border Continue to.

Utah Man Sentenced for Hate Crime Attack of Three Men

Utah Man Sentenced for Hate Crime Attack of Three MenTuesday, August 8, 2023 A.

Green Energy Company Biden Hosted At White House Files For Bankruptcy

Green Energy Company Biden Hosted At White House Files For BankruptcyAug 7 (Reuters) – Electric-vehicle parts.

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrn

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrnFriday, July 21, 2023 A former.

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human Remains

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human RemainsSCRANTON – The United States.

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide Demonstrations

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide DemonstrationsThe Department of Justice announced that.