General Electric said Monday it was cutting its dividend in half, a move that could cause many long-time shareholders in the 125 year-old conglomerate to flee, but also free up much needed capital to fund a turnaround for the one-time American bellwether.

GE said it was cutting its quarterly payout to 12 cents a share from 24 cents a share, effective in December. Shares, which are down more than 35 percent for the year, rose more than 2 percent in premarket trading on the news.

“We understand the importance of this decision to our shareowners and we have not made it lightly,” said John Flannery, chairman and CEO of GE, in a statement. “We are focused on driving total shareholder return and believe this is the right decision to align our dividend payout to cash flow generation.”

Flannery hinted in the release that more changes will be announced at the company’s investor day at 9 a.m. ET.

“With this action and others that we will be discussing this morning, we are acting with urgency to make GE simpler and stronger to drive growth and create more value for our shareowners,” the statement read.

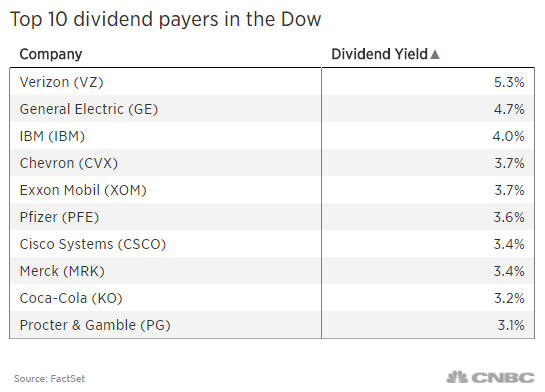

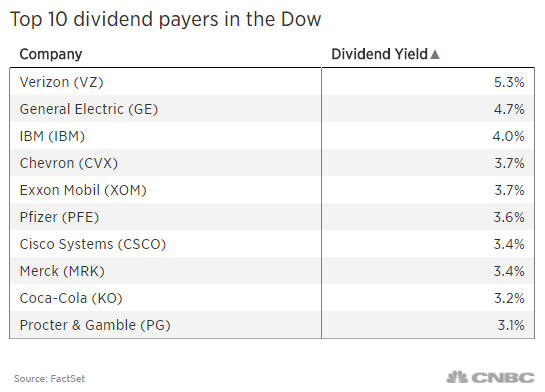

Heading into Monday’s announcement, and as GE’s shares cratered, its dividend yield had ballooned to the second-highest in the Dow behind Verizon at 4.7 percent (Verizon’s yield is 5.3 percent). That caused many analysts to speculate the payout was unsustainable, which explains why the stock was stable in early trading as this decision was long expected.

GE has paid a dividend since 1899 and has only cut it twice before, once in 1939 and again in 2009.

Wall Street had been expecting some type of action on the dividend, with speculation that GE might opt to eliminate it altogether.

GE’s free cash flow, or the level of cash flow less capital expenditures, had contracted to about $7 billion, about half its normal level. The dividend slash is expected to generate $4 billion in cash annually.

“If you look at the last five years, the industrial cash flow of General Electric has not covered the dividend,” Jeffrey Sprague, Vertical Research Partners founder and a long-time GE analyst, told CNBC. “That was fine previously when you had GE Capital there to pay its fair share. But with Capital gone, there’s just no way to pay the dividend.”

The move comes as the company tries to sharpen its focus, under heavy criticism from investors and analysts who believe GE’s sprawling interests have become unwieldy and unmanageable.

Among expected changes to the company is a focus on three of the company’s prime business lines — aviation, power and healthcare, according to a report in the Wall Street Journal. There do not appear to be plans for an imminent breakup, but the company is expected to exit most other business lines, the Journal reported.

GE is expected to shed its majority stake in oil and gas operator Baker Hughes, which became a separate publicly traded company in July after it merged with GE’s oil and gas operations.

The dividend cut is considered a landmark decision considering GE’s tradition as a must-own stock for investors concerned with income generation. The move, along with the company’s other troubles, has sparked speculation that GE actually may lose its standing as a Dow industrials component, even though it is the sole original member of the bluechip index.

—With reporting by Morgan Brennan.

more recommended stories

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl Trafficking

Fentanyl Seizures at Border Continue to Spike, Making San Diego a National Epicenter for Fentanyl TraffickingFentanyl Seizures at Border Continue to.

Utah Man Sentenced for Hate Crime Attack of Three Men

Utah Man Sentenced for Hate Crime Attack of Three MenTuesday, August 8, 2023 A.

Green Energy Company Biden Hosted At White House Files For Bankruptcy

Green Energy Company Biden Hosted At White House Files For BankruptcyAug 7 (Reuters) – Electric-vehicle parts.

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrn

Former ABC News Reporter Who “Debunked” Pizzagate Pleads Guilty of Possessing Child pδrnFriday, July 21, 2023 A former.

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human Remains

Six Harvard Medical School and an Arkansas mortuary Charged With Trafficking In Stolen Human RemainsSCRANTON – The United States.

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide Demonstrations

Over 300 People Facing Federal Charges For Crimes Committed During Nationwide DemonstrationsThe Department of Justice announced that.